TL;DR: GMX trades at a very low valuation relative to other peers in the perpetual trading space. I sat down with the team to hear about the roadmap, relative advantages, and model cash flows for the protocol. Assuming growth is sustained at just 25% of historical levels, we could see GMX token price as high as $111.46 (‘23), or 210% upside from current valuation.

The Tie Research

GMX: Comparative Valuation of DeFi Perp Trading

I’ve done some work on market sizing Spot vs. Derivative markets in Crypto, as well as contextualizing the relative size of those markets for CeFi vs. DeFi.

In short, TAM for derivative markets is significantly larger than spot. By my estimates, if the total market cap of crypto is ~$10tn in 5 years, there will likely be an accompanying derivatives volume of $70-100tn. That’s between $50-80tn of volume to be captured!

At the moment, the vast majority of derivative volumes are being dealt through centralized entities. This is largely due to a series of key issues that regularly plague their DeFi counterparts:

- Low liquidity

- Unfair pricing – for buyers and/or writers

- Lack of composability

- Lack of user adoption

- Lack of protocol adoption

- Arbitrage opportunities during times of high volatility

As protocol innovation solves these issues, and as regulatory pressure reduces leverages and offerings on CeFi perpetual protocols, I fully expect decentralized share to increase. The data seems to support that growth, albeit slowly. Total DEX perpetual volume market share increased from ~0% to ~3% in Q4’21. Of that, dYdX made up 2.22% of the entire DeFi perpetual exchange volume.

So, if we secularly expect decentralized perpetual protocols to grow over the coming years, who are the relative winners in the space? As it stands right now, there are two noteworthy protocols to highlight: dYdX, the incumbent, and GMX, the challenger. Also making smaller headlines in the space are teams like Perpetual Protocol and Synthetix.

GMX trades significantly cheaper than its closest competitors, and I had a chance to sit down with the team at GMX to figure out exactly why. They were kind enough to share lots of alpha on the roadmap for the protocol, the tokens (GMX and GLP), and the space. Plus, we were able to collaborate to produce a very thorough investor model, which includes cash flows (separated by chain), comps vs. TradFi peers, and adjustable assumptions for future growth. Needless to say, there’s a lot of theorycrafting actively occurring, and the protocols that best solve the issues above will be able to best capture TVL moving forward.

If you’re unfamiliar with the basic GMX model, I’d recommend skimming through this piece by Delphi Digital, or this piece, by Riley. It covers a lot of the basic protocol mechanics that will be addressed, but not covered in depth here for the sake of brevity.

A Brief History of GMX

Before GMX there was Gambit. The Gambit team built the original GLP model, but under the guise of issuing an over-collateralized and interest-generating stablecoin, USDG. It successfully generated a lot of revenue, based on assets under management, but had a few main issues:

- Bots front-running user trades (that’s why there’s protection built into GLP)

- Difficulty of maintaining the dollar peg of USDG

- Providing farm tokens, without any use cases or incentives other than accumulating or selling

After this experience, the team decided to re-launch under GMX. The key difference was the exchange of USDG for GLP (free-floating price) as the representative token for asset pool. Additionally, they realized that launching a perp-trading protocol on ETH mainnet would have come with gas-intensive problems.

Instead, when GMX launched on 9/6, it was in tandem with Arbitrum as one of the original protocols (along with Dopex). The goal was to serve as a centralized execution hub for the L2, while using the time to refine the GLP model and tokenomics. The ultimate goal is to take their unique 0-fee perp trading experience and deploy cross-chain, which we’ve already seen starting to happen with their move onto AVAX.

GMX vs. Peers

With a number of synthetic & perpetual trading protocols available on-chain, differentiating between their long-term value propositions becomes increasingly important.

Unlike GMX and SNX, dYdX and PERP currently do not pass through any trading fee revenue generated to token holders. PERP has announced plans to begin a pass-through with the rollout of their v2 program; dYdX appears to have no such intentions. Sharing in trading fees allows users to capture upside from their preferred platform. If volumes grow, then yield will scale accordingly.

This relative value proposition is likely a key component of why SNX and PERP trade at significantly higher revenue multiples than dYdX.

Also worth noting is that GMX pays out a portion of staking yield in the native token of the chain that you’re staking on. So, users on Avalanche receive AVAX, and those on Arbitrum/Ethereum Mainnet receive ETH. This allows for user self-selection into preferred reward, and creates natural diversification into a less-risky asset.

As the two largest protocols by platform trading volume, it’s worth doing a slightly deeper comparison between dYdX and GMX.

When I sat down with the team, we spoke about what they see as their key differentiators:

1) Liquidity Model - GMX allows users to enter positions in size and have no impact on price. There is no other DeFi protocol where a trader can leverage 500 BTC, and not have it impact order book prices.

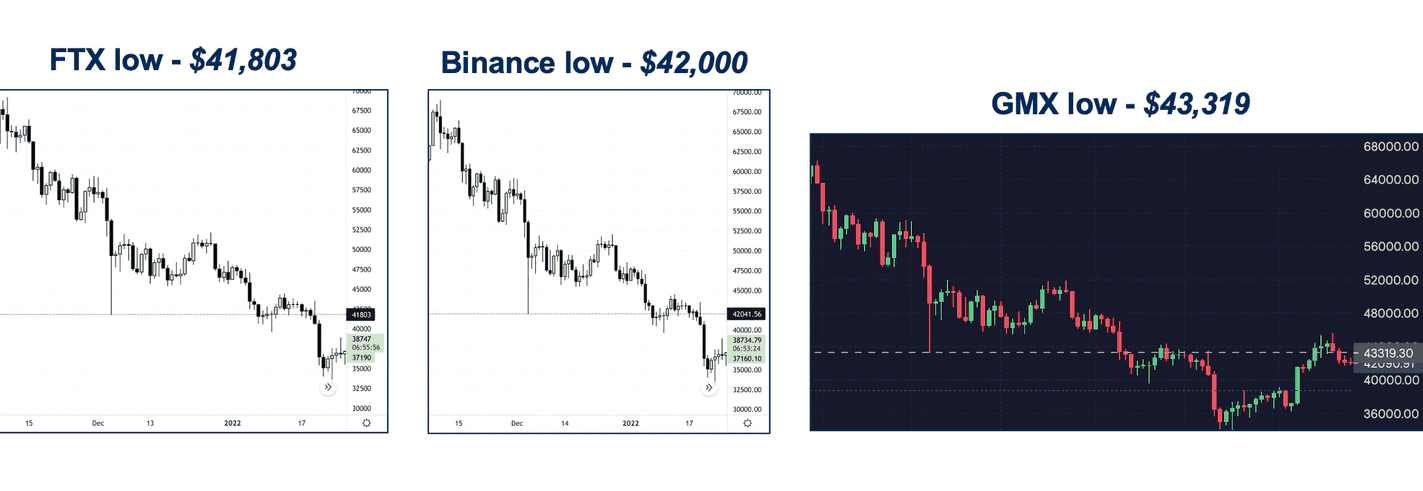

2) GLP - GLP doesn’t use an x*y=k AMM model. Instead, it uses a decentralized counterparty clearing house structure. Rather than price-weighting their pools, they pull prices from Chainlink oracles, which avoids some arbitrage issues. To further insulate the protocol, they recently added a 1.5% move or 12-hour take-profit rule to prevent front running.

3) Disintermediation of the price-keeping mechanism - Eventually there will be third parties, like Keeper DAO, maintaining price feeds. This will allow GMX to extract arbitrage opportunities within the system- similar to FRAX’s AMO model. This creates further extracted value for GMX stakers.

4) Risk Management - Most generic perpetual protocols rely on automation. Price integrity is all virtually determined, rather than working on-chain. This enables certain solutions for traders, but simultaneously opens the protocol up to black swan risk. Perpetual Protocol now, for example, has to insure their entire liquidity pool.

For GMX, the closest thing to a black swan event would be that prices drop and shorts increase across the board, ETH falls, and the protocol has to pay out rewards. However, this is not an idiosyncratic risk.

Roadmap

Based on my conversation, the team’s very first priority is to scale as a platform. As long as GLP TVL is up, the protocol’s ability to handle more volume rises, and, in turn, fee generation increases.

As such, the goal for collaborations is to get as many large depositors of GLP as possible. To do this, they’re searching for projects that have communal treasuries, where GLP can help efficiently optimize yield generation. Some of the first partnerships were with ReFi, Reverse Protocol (Avalanche - $93k of GLP), Congruent ($5mn GLP), Umami, and Jones DAO. Their goal? Half a billion of assets in GLP.

The GLP pool on AVAX is currently about a third the size of its Arbitrum equivalent, and is generating just under 30% of volume & fees. As the pool naturally scales through AVAX-based partnerships, it will create low-hanging fruit for GLP uptake. Given that Avalanche is processing ~10x as many transactions/day, expansion onto alternative Layer Ones represents a substantial continued opportunity. The team plans to continue deploying the product on EVM-compatible chains- perhaps BSC next, as an homage to the original Gambit.

Phase Two of the roadmap has been focused around structured products. Examples include Vovo Finance, which allows users to leverage yield; Vesta Finance, where you can borrow against your GMX; and, Jones DAO, where the goal is to create a delta-neutral vault using Dopex Vaults, and hedge with short perpetual positions on GMX.

Also worth noting is the rollout of the X4 AMM. This will include a ton of interesting new functionality such as allowing users to customize dynamic fees for swaps, creating custom curves for hard-to-trade tokens, liquidity aggregation and bootstrapping, and PvP AMM models.

Model, Valuation, and Risk/Reward:

Now we get to the real alpha.

GMX trades cheaper on a relative basis than any of its decentralized counterparts, and significantly cheaper when compared to other protocols with plans to pass through generated fees (SNX, PERP). In collaboration with the GMX data team, we put together a full investor model.

Two assumptions to note:

- Given its fee pass-through, GMX behaves very differently than governance tokens like dYdX. We selected TradFi companies including CME, CBOE, and Nasdaq as comps for the business. The mean multiple for these businesses is ~21x EV/Forward EBITDA, which we then take as a projected multiple for GMX.

- Trading Volume and Fee Volume have been averaging 15-20% growth week/week over the past 31 weeks. We used a much more conservative assumption of 5-6% average growth w/w over the next 1-2 years.

Given these constraints, upside for GMX remains incredibly lucrative. Current GMX price sits at $36, with a projected Year 1 price (~20 weeks remaining) of $74.31, representing 106% upside.

On a two-year time horizon, growth expectations project a future price of $111.46, or 210% upside from current valuation.

If you’re interested in seeing upside / downside with various other assumptions, you can make a copy of the sheet and customize the growth assumptions in B14,15, and 16.

Obviously, there remains a variety of factors & risks that will influence this outcome:

- Team Execution on stated roadmap

- Continued growth of Partnerships

- Sustained growth at 5-6% w/w for the next year

- Oracle Exploit Risk

- Market realization of mispricing relative to TradFi and DeFi peers

That said, given staking rewards of 28% (11% ETH, 17% GMX), risk / reward remains biased to the upside. Furthermore, risk to the downside is mitigated through exposure to native chain assets vs. solely protocol governance token.

Feel free to play with the assumptions in the model, and would love to hear any feedback as we continue to refine the process of cash flow projection in web3!

This report is for informational purposes only and is not investment or trading advice. The views and opinions expressed in this report are exclusively those of the author, and do not necessarily reflect the views or positions of The TIE Inc. The Author may be holding the cryptocurrencies or using the strategies mentioned in this report. You are fully responsible for any decisions you make; the TIE Inc. is not liable for any loss or damage caused by reliance on information provided. For investment advice, please consult a registered investment advisor.

Sign up to receive an email when we release a new post