Over the past few weeks, vote-escrow (or ve) tokens have seen an outsized move in both discussion and price. Through the Coins Profile on SigDev, I was able to quickly pinpoint and evaluate the events that caused spikes. The Coins Profile is a new product we just rolled out that gives users a comprehensive overview of each token, and provides benchmarks to identify relative opportunities.

The Tie Research

AlphaDrops Case Study: CRV, VELO, OP

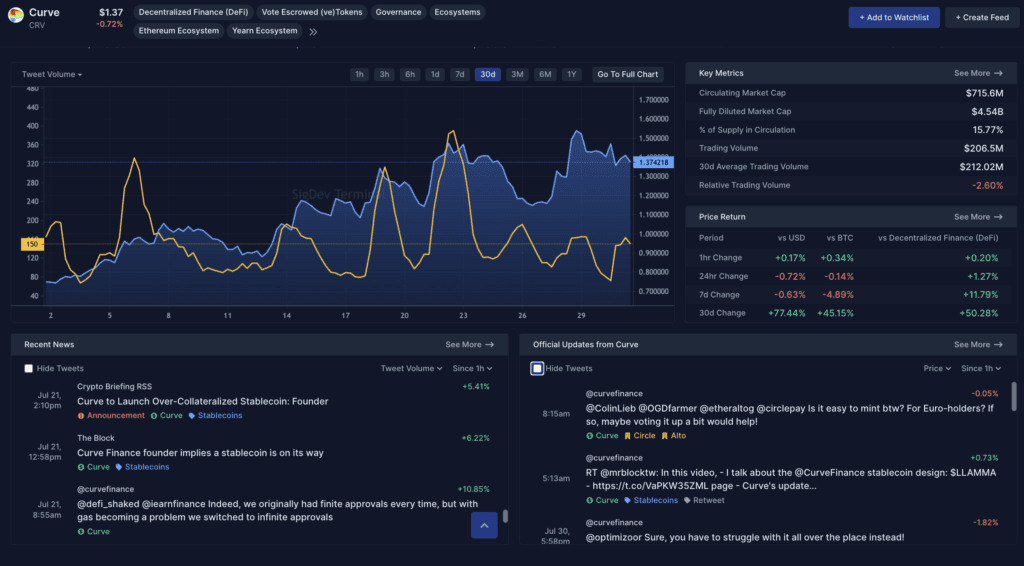

With the use of the new page, I was able to supplement on-chain analytics through our news/sentiment data and research charting to discover that action was largely driven by two major catalysts- Curve and Velodrome/Optimism. While one spike was unexpected, following the resulting information through SigDev allowed us to clearly see a surge in VELO and OP positive factors days before their token price jump.

Curve

First was Curve’s announcement of an upcoming over-collateralized stablecoin.

Early morning US-time, a Thailand-based investment firm SCB 10X tweeted about their discussion with Curve Founder, Michael Egorov, on a new overcollateralized stablecoin. Shortly thereafter, this was picked up by a few major publications (like the Block), sending 1hr discussion volumes up 11%. This update drove conversation up over 400% at peak, and price up over 40%.

The on-chain trail confirms what the social and price movements suggest. Looking at the data, we immediately see that two of the largest monthly transactions (including the largest by a wide margin) occurred shortly after the stablecoin announcement.

On top of that, CRV meaningfully outpaced the broader AMM marketplace, running circles in every on-chain activity metric.

Interestingly, you may initially suspect (as I did) that this rise is likely driven by retail investors buying the news from major headlines. The on-chain data told a completely different story. Accumulation was actually largely executed by Whales, with retail preferring to sell the news.

After seeing this large-holder driven increase, I was carefully following Curve news for the remainder of the week. Just a few days later, on the 24th, a fairly innocuous set of tweets piqued my interest.

Curve deploying its AMM structure represented an interesting yield-farming opportunity, as well as a potential competitor for Velodrome, the only Optimism-native protocol in the top 10 by TVL on the rollup. Due to its similar tokenomics, Velodrome closely resembles Curve. In reality, the project’s goal is much grander- realizing one of the grandest failed undertakings of DeFi 2.0: Andre Cronje’s Solidly.

Optimism / Velodrome

With the added eyes on ve-tokens I wanted to do a bit more digging on the situation on Optimism and Velodrome. From July 13th to July 31st, TVL on Optimism increased from $291mn to $622mn- a 113% spike. Despite this, Optimism continued to trade in relative lockstep with Ethereum. This continued until July 28th, with OP soaring back above airdrop price shortly after.

This rise in TVL was largely driven by Synthetix (SNX, a trading protocol) and Velodrome (VELO).

An outsized portion of this growth was from Velodrome, who grew TVL from $32mn to $137mn - a 425% increase that easily outpaced all other protocols. This growth was simultaneously reflected in the news growth on Optimism, which saw flying TVL numbers equaling heightened coverage.

Needless to say, the battle for liquidity in the ve-Token marketplace remains high and worth following.

To learn or more about TIE’s Coin Page Schedule a demo.

This report is for informational purposes only and is not investment or trading advice. The views and opinions expressed in this report are exclusively those of the author, and do not necessarily reflect the views or positions of The TIE Inc. The Author may be holding the cryptocurrencies or using the strategies mentioned in this report. You are fully responsible for any decisions you make; the TIE Inc. is not liable for any loss or damage caused by reliance on information provided. For investment advice, please consult a registered investment advisor.

Sign up to receive an email when we release a new post