NFTs are, by nature, non-fungible. This has caused issues around provision of deep liquidity and regular trading markets. Historically, this thin liquidity has been a driven by a few main factors:

The Tie Research

Sudoswap: NFT Concentrated Liquidity

State of NFT Liquidity

- High protocol fees and royalties add a lot of friction to liquidity.

- Differing traits on NFTs collections cause pricing off-floor to be inconsistent, and difficult to model via traditional v2 AMM curves.

- Fractionalization of NFTs (NFTX, NFT20) helps deepen liquidity on NFTs, but forces people to trade portions of an NFT. This adds difficulty making markets on specific rarities or custom traits. Fractionalization also reduces asset composability, and renders it useless outside of the original system.

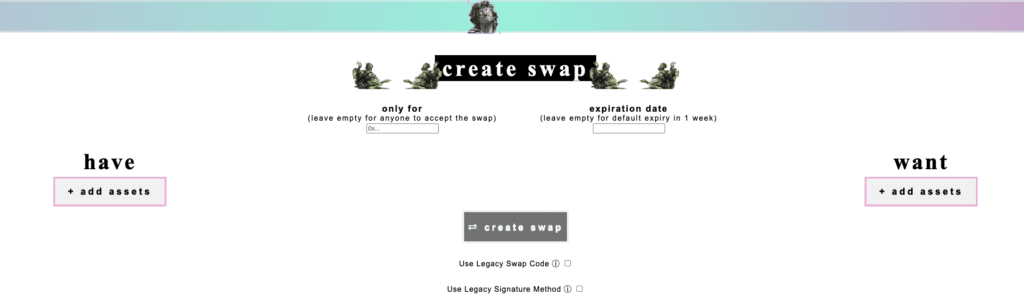

Over the past year, an under-the-radar, but incredibly effective, NFT marketplace known as Sudoswap has built up a loyal fanbase. In their v2 of their protocol (currently live), they offer multi-asset, non-custodial, and gas-optimized swaps.

We had a chance to chat with anonymous founder 0xmons to get a sneak preview of the upcoming release (which is a huge upgrade over current UI/UX), chat about relative value proposition compared to other NFT marketplaces, and learn about the backend protocol infrastructure.

0xmons ultimately plans for Sudo to be a widely used protocol for NFT trading, rather than just a cost-efficient swap mechanism as it is now. The end goal is to create a user-friendly experience, driven by Sudoswap’s unique backend technology, as well as a liquidity aggregator to offer best-in-class pricing depth, listing fees, and customizability.

Before diving fully into the planned updates for the protocol, it’s worth revisiting some of the current differentiating factors that have allowed Sudoswap to drive $100mn+ annualized of NFT swap volume. While the NFT AMM update will represent a major update, the majority of the underlying technology will carry over into the new iteration, and be a driving force for success down the line.

Brief History of Sudoswap

Casual NFT collectors have largely avoided Sudoswap, even mistaking it as a phishing site. The minimalist front end doesn’t necessarily offer the most functionality for discovering and browsing collections, leaving its current use-case largely limited to OTC swaps. Despite that restriction, Sudoswap has maintained 1.4k unique users over the past 30 days of market volatility, making it comparable with protocols like Sandbox and Rarible.

Below the humble surface, Sudoswap differentiates itself through a structural trifecta: gas-efficient & non-custodial swaps, low fees, and multi-asset swaps. On a transactional level, swaps are cheaper when compared to a similar transaction on Opensea.

A non-custodial backend means that Makers pay no gas to list - only sign a transaction. Takers pay a fee to execute the swap, which is at equal to, if not cheaper than, swapping on another major NFT exchange. NFTs can be exchanged for ETH, like other platforms, or swapped into any combination of a variety of ERC tokens.

On top of it all, Sudoswap doesn’t charge any fees. Needless to say, it quickly became popular with the more involved NFT trading audience. With the rollout of sudoAMM, 0xmons mentioned that fees will likely initially rise to just under 1%, which still puts them at a substantial discount to platforms like Opensea charging 2.5%.

sudoAMM

By far the most popular AMM model for trading fungible tokens is the x*y=k AMM Bonding Curve. Given the natural volatility of crypto, a liquidity provision strategy that minimizes price slippage, but requires no liquidity rebalancing (passive investing), is valuable. The x*y=k curve is generally effective for fungible tokens, and slippage is fairly minimal for the most heavily trafficked pairs on mainnet.

Two main factors, leading to two distinct types of markets, make x*y=k generally unsuitable for trading whole NFTs:

- People prefer trading whole NFTs (Opensea), as opposed to fractionalized alternatives. Part of the surge in NFT activity has been driven by a desire to hold specific items, rather than generalized exposure. This has led to protocols like Opensea, which allow users to trade and filter for specific items in a collection. Finding immediate liquidity here often requires execution significantly below ‘fair market value’.

- NFT collections generally have significantly smaller circulating supply (NFTX). Fractionalization helps with this, leading to protocols like NFTX, who fractionalize NFTs within collections to help with liquidity. Even in fractionalized protocols, the x*y=k model’s bias to never run out of liquidity is visible, and the majority of available assets remain idle.

Token liquidity has dealt with a similar issue, leading to the creation of ‘concentrated liquidity’ in Uniswap v3. Sudoswap AMM hopes to create a similar concentrated liquidity product for the NFT space, but without the downsides of tokenization. A tokenized v3 model would provide effective liquidity, but does so at the cost of gas (extra transaction on every swap) and native support for different trading strategies. While many of these options are possible for Uniswap v3 positions, they remain practically infeasible without the use of outside liquidity managers.

Planned Offerings

SudoAMM plans to offer flexibility for both LPers and Traders on the site, allowing them to:

- Adjust LP price range(e.g. from [0.667 ETH, 1.5 ETH] to [0.5 ETH, 2.0 ETH])

- Adjust current pool price (e.g. from 1 ETH to 0.75 ETH, buy/sell quotes automatically adapt)

- Adjust the fee % taken on buys/sells

- DCA in & out of positions, via single-sided liquidity pools

Most importantly, this structure offers the best of both worlds - OpenSea fans are able to trade whole NFTs, but are able to get instant buy/sell quotes at ideally much closer to fair-market value.

All of these strategies are executed through the use of custom bonding curves. Novice users will be able to choose from a selection of pre-set mechanisms, while more advanced traders will be able to adjust execution to their heart’s content.

Yesterday, Sudoswap announced the launch of their new SUDO token. Distribution is planned as follows:

The vast majority of the new distribution will go to XMON holders, with tokens owned by the team Treasury ineligible. To claim SUDO, holders will participate in a token lockdrop, requiring locking XMON for 3 months to claim SUDO at a rate of 1 XMON : 10,000 SUDO.

In addition, small shares will be given to 0xmons NFT holders, as well as those that deposited two-sided liquidity on the SudoAMM platform pre-launch.

Comparative Advantage

So, given the multitude of NFT tradition options. Why migrate listing and buying to Sudo?

- A substantially lower fee model. Both LookRare and OS are charging single digit percentages, while Sudoswap charges less than 1%. Aside from Seaport, which isn’t out yet, Sudoswap is significantly cheaper for swaps than peers. After Seaport’s release, comparable gas costs may change.

- Flexibility. If Sudoswap is able to have listings supported via aggregator, then discoverability becomes less important than offering best pricing in the short term. Aggregation will also make LPs very profitable to start.

- Composability and participation. Pools are on-chain, so DAOs and multi-sigs can manage them without delegating for signing, or writing custom governance code. There’s a lot more programmability available off-the-shelf. This would allow for the creation of custom products & pools, like we’ve seen for Uniswap v3.

This report is for informational purposes only and is not investment or trading advice. The views and opinions expressed in this report are exclusively those of the author, and do not necessarily reflect the views or positions of The TIE Inc. The Author may be holding the cryptocurrencies or using the strategies mentioned in this report. You are fully responsible for any decisions you make; the TIE Inc. is not liable for any loss or damage caused by reliance on information provided. For investment advice, please consult a registered investment advisor.

Sign up to receive an email when we release a new post