When discussing and analyzing project tokenomics, investors tend to focus on three main areas:

The Tie Research

The Token Economy – Introducing a Framework for Token Policy

- Token distribution & allocation

- Token utility

- Token supply and unlock schedule

Although these three factors are undoubtedly critical, understanding the fundamental characteristics of both tokenizing assets and the token economy is helpful for builders and investors.

Before digging deeper into this fundamental analysis, I will introduce the concept of a token economy. Understanding this concept well will not only allow builders to create sustainable projects and token economies, but also help investors develop a framework for assessing the intrinsic value of projects in the market.

The Token Economy

The global economy can be broken down into smaller sub-economies, such as countries, organizations, or groups of individuals. Similarly, within each crypto project, people participate in the ‘token economy’, conducting a range of activities related to the production, consumption, and trade of goods and services within a project ecosystem.

Whenever someone gets paid in an economy, someone is providing payment in exchange for goods or services. An economy also tends to have its own rules and constraints to help encourage cooperative and mutually beneficial behavior within the ecosystem. The same principle applies to web-based and blockchain economies.

For a blockchain economy that focuses on producing and selling block space, the protocol's token policy is designed to incentivize validators to join and help secure the network, so that people feel comfortable transacting within the ecosystem instead of via competing protocols or other avenues.

The productivity and reliability of an economy determines how valuable the currency of that economy is relatively compared to others. When an economy can create and export goods and services to other economies, it will increase the demand for its native currencies and make them more valuable than other economies' native currencies over time.

However, it is not easy for an economy’s supply and demand to reach an equilibrium that enables efficient increase in the economy’s size. According to Modern Monetary Theory, this is where governments and central banks intervene and leverage monetary policy to optimize the balance of supply and demand.

Governments tend to change policies to encourage buyers to spend more when there is a lack of demand, raising the productivity of the whole economy to avoid a long run supply shortage.

The same principle also applies to crypto projects and tech startups. By paying high salaries for developers to build scalable products, tech startups are also spending a lot of money to fuel the demand growth.

With traditional tech or web 2.0 companies, teams utilize the cash raised to help their business create products or gain traction. The companies that do this effectively are able to survive, and have a chance to become the top tech companies in the world. Others will fail after ineffectively burning all the cash they raised from investors.

While most Web 3 startups are using the same growth model, there are differences in how cash is leveraged to stimulate the economy.

Stimulus takes the specific form of token issuance, with governance teams or the protocols using token policy to encourage desired behaviors.Token receivers can either hold the tokens for investment/utility purposes, or sell their tokens to the open market.

If there is a person selling something, there has to be a buyer on the other side of the trade. Therefore, there has to be more demand for the tokens than the selling supply to keep the price of the tokens increasing in the long run.

Fundamental Token Demand

Take Ethereum as an example. The chain is designed to incentivize people to download server software and run nodes to help secure the network, provided they can meet some requirements such as possessing an expensive GPU (PoW) or 32 ETH to stake (PoS). After successfully validating transactions and keeping the network secured, these validators receive token rewards that they can either hold or sell.

On the other hand, the blockchain users who believe in the network's security and want to perform economic activities on this blockchain (transact, deploy dApps, build businesses, stake nodes) will buy $ETH from exchanges and use it to pay gas fees. If the demand for $ETH used as a gas fee grows faster than the selling pressure from staking/mining rewards, the currency has achieved a sustainable equilibrium.

In this case, the higher the staking/mining rewards (including the gas fees), the more people will join the network as validators, which helps the network become more decentralized and therefore more secure. Once the network becomes safer, more people will want to transact on the network, thus increasing the value of block space and demand for the network. Of course, there are diminishing returns on the increase in network security relative to staking demand. Therefore, the governance teams and the community should track this trajectory to know when it could be better to allocate more resources to other parts of the economy.

This exact mechanism applies to other Layer 1s and Layer 2s such as Bitcoin, Avalanche, and Polygon.

Paying for the Cost of Business

The U.S economy is driven by the Federal Reserve and U.S government deploying monetary and fiscal policy. Monetary policy helps control the money supply flow in the market, and fiscal policy helps distribute the additional printed money to different participants in the economy. Whenever the money supply increases faster than the demand for goods and services produced in the economy, that money will lose some of its purchasing power, a.k.a inflation.

The same concept applies to the token economy. Tokens will lose their purchasing power whenever the token’s floating supply increases faster than the demand for the protocol's product.

Since increasing the floating supply causes tokens to lose their purchasing power, those driving token policy should be very cautious about how much supply inflation occurs over time. They also need to be thoughtful about distributing that number of tokens effectively, incentivizing the target participants to contribute positive value without engaging in free-rider behavior that saps value.

Subsidizing Security, at the cost of Inflation

With the successes and growing popularity of Proof of Stake protocols, hundreds of different projects in the market have tried to adopt a staking mechanism. Some projects fueled their staking yields with large emission rates to attract token stakers. Those staking yields were clearly unsustainable. These yields targeted one, and only one, objective: incentivize people not to sell their tokens.

Putting the ponzi-nomics aside, let's analyze fundamental yield - layer 1s that add security value to the network in the form of staking or mining.

Let's use the national security expense as an analogy to help understand a “subsidized rate” metric that we’ll shortly introduce.

Most countries in the world allocate a budget for military and national defense to enhance the safety of their territory. When a nation becomes more stable and safer, people are also more comfortable conducting economic activities within that economy to create goods and services.The national security expense is often funded by taxes and inflation (the money printed out by the FED, and then given to the government as national debt).

Similarly, for the Layer 1 blockchains to be usable and stable, their token economies must also fund "security expenses" by giving out validation rewards. Two sources currently support these rewards:

1. Transaction Fees from the network’s users, which can be seen as the equivalent of taxes.

2. Block Rewards or Staking Rewards (excluding transaction fees), which are freshly minted or released from the staking pool as security incentives (subsidized).

This naturally leads to the question of how much of a chain’s security expense can be covered by transaction/gas fees alone? In other words, what portion of the security expense of top layer 1 blockchains is subsidized?

To explore this question, we gathered some data, seen in the chart below:

Most of the security expenses of top layer 1 projects in the market, such as Bitcoin, Ethereum, Avalanche, and Polygon, are bouncing around 85% - 100% subsidizing rate. That also means that transaction fees only cover 5% - 20% of the "security expense" of the networks.

Ethereum, without EIP1559, comes closest to an unsubsidized network. At the bull market peak, the Ethereum protocol revenue (gas fees) could have covered 50% - 70% of the "security expense," while other networks still heavily rely on subsidized rewards.

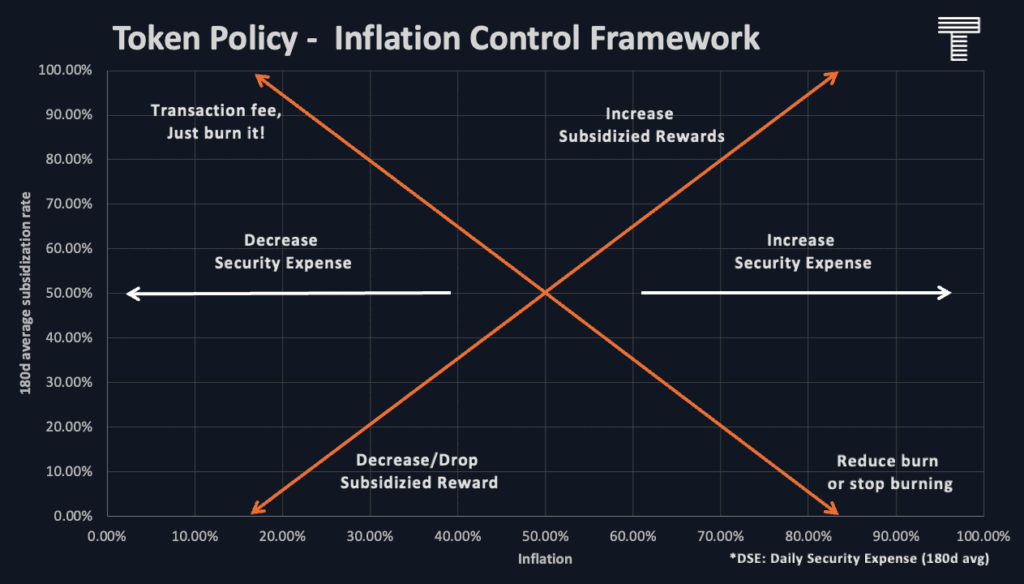

We can also plot the 180 day average of daily security expense subsidized rate) on the chart against the token’s inflation rate to see the impact of policy control, as well as to determine what policy the project might take to improve the token economy.

From the chart, we can see that Ethereum reduced their inflation rate significantly (from 2.65% to 0.5%) by burning 80% - 90% of transaction fees, as the gas fees would have covered 50% - 70% of the network security cost. This token policy (EIP-1559) cut down the daily security cost of the network by 42% (from $47M to $33M).

If a country's GDP is small but it decides to print money to fund its national defense, that would typically cause high inflation. Being able to visualize the network’s expenses, and who is funding those expenses, can help the community make better decisions on token policy and sustainable tokenomics.

It is possible that the projects can move on themselves on the chart without any token policy change. When more users want their block space, their protocol revenue (total transaction fees) will increase. For example, if Polygon’s protocol revenue (total gas fees) starts to increase significantly, they will move down on the chart, giving them room to either reduce the staking reward or start to burn transaction fees.

Although Avalanche might look extreme at a glance since they are a young project with an aggressive growth strategy, their token policy of burning 100% transaction fees was explicitly crafted around enabling deflation in the long run. With this policy, the deflationary effect of growing gas revenue is much greater than that of other protocols. This token policy may help AVAX rapidly shift once protocol revenue is sufficiently high, achieving a long-term deflationary goal while preserving the security level with predictable subsidizing rewards.

Token Policy - Inflation Control Framework

A complex set of objectives including security level requirements should be considered by any blockchain community deciding on its token policy. The framework below provides a useful map of decision points in terms of subsidy rate and inflation:

For instance, if Bitcoin wants to reduce inflation or turn itself into a deflationary asset, burning all transaction fees will not help much since 98% of the security cost is currently funded by block rewards. Therefore, the Bitcoin community can consider reducing or dropping the block reward to reduce the inflation rate, which is already baked into the Bitcoin Halving Policy. In the future, when the block rewards are significantly smaller than now, the decision to start burning transaction fees would have a more significant impact in reducing inflation, or helping bitcoin become a deflationary asset.

On the other hand, if the mining cost of Bitcoin starts to increase and profitability goes down (or the last Bitcoin is mined), a drop in the number of miners might threaten the Bitcoin network's security. In this situation, the Bitcoin community can use the above framework to decide whether they want to increase block rewards or stop burning gas fees to keep the network up and running safely.

Please note that a high subsidization rate might contribute to the inflation of the token, but is not the main factor that causes inflation for a project. Insufficient resource allocation to any economy participants can cause the native currency of an economy to lose its purchasing power. Moreover, high inflation may be justified if the network can achieve outstanding growth in a short period.

Effects of Burning

Is burning always good? The short answer is no. Although burning tokens will increase the purchasing power of tokens, policymakers should be mindful of who is affected by the fire.

For instance, under Ethereum’s (EIP-1559) and Avalanche’s burning mechanisms, a big chunk of spent gas fees are removed from the staking/mining reward. In this case, the validating nodes are the ones feeling the heat. Suppose the burning rate is significant enough that validating nodes cannot become profitable; would-be validators will leave the economy and/or invest their capital into another protocol, potentially reducing decentralization and network security.

Although these validators will also benefit from higher purchasing power, the situation is similar to when employees who own ESOP or company stock must take pay cuts. Although accepting the pay cut will help their company become more profitable - which will benefit the ESOP and equities in the long term - pay cuts happening amidst uncertainty in long-run company valuation might cause the employees to quit.

During a bear market, when people spend less on transaction fees, a high burn rate combined with downward movement of the tokens' price might reduce the count of validating nodes, which then hurts the network’s decentralization. This downtrend can also start a positive feedback loop where the network becomes less secure over time, causing users to feel unsafe with their funds and decide to leave the ecosystem, which in turn further reduces transaction fees.

Closing Thoughts

The framework above exemplifies one method for applying macroeconomic principles to examination of a token economy. This framework will not only help investors improve their risk analysis and fundamental analysis, but will also help builders and the community gain insight into what token policies they should adopt for each growth stage of a project.

Giving out more staking rewards is more likely to hurt than benefit token holders if they don’t or can’t stake. Although burning transaction fees helps increase the purchasing power of the tokens, which benefits all token holders, poor timing might hurt and threaten network security. The situation would be similar to the Federal Reserve raising interest rates and deploying Quantitative Tightening during recessions.

This report is for informational purposes only and is not investment or trading advice. The views and opinions expressed in this report are exclusively those of the author, and do not necessarily reflect the views or positions of The TIE Inc. The Author may be holding the cryptocurrencies or using the strategies mentioned in this report. You are fully responsible for any decisions you make; the TIE Inc. is not liable for any loss or damage caused by reliance on information provided. For investment advice, please consult a registered investment advisor.

Sign up to receive an email when we release a new post